Tax Incentives – Thailand’s Special Economic Zones (SEZs) offer a golden opportunity for investors seeking attractive benefits and strategic advantages in Southeast Asia. To encourage investments, the Thai government has introduced a significant tax incentive: businesses operating in SEZs enjoy a reduced corporate income tax rate of 10% for 10 years.

This policy, approved by the Cabinet on January 13, 2025, is implemented through a royal decree, underscoring the government’s commitment to fostering a pro-business environment.

Thai Revenue department Development Sector

According to the Revenue Department, this tax reduction applies to companies or juristic partnerships engaged in industries designated by the SEZ Policy Committee. Crucially, this benefit is not limited by the location of a company’s headquarters but focuses on income generated through goods produced or services provided within SEZs.

The initiative aims to stimulate production, service activities, and employment in these zones while strengthening connections with major economic areas and neighbouring countries. As a result, Thailand is set to enhance its competitiveness and position as a regional trade and investment hub.

About Special Economic Zones:

Development and Investment Promotion in Thailand SEZs

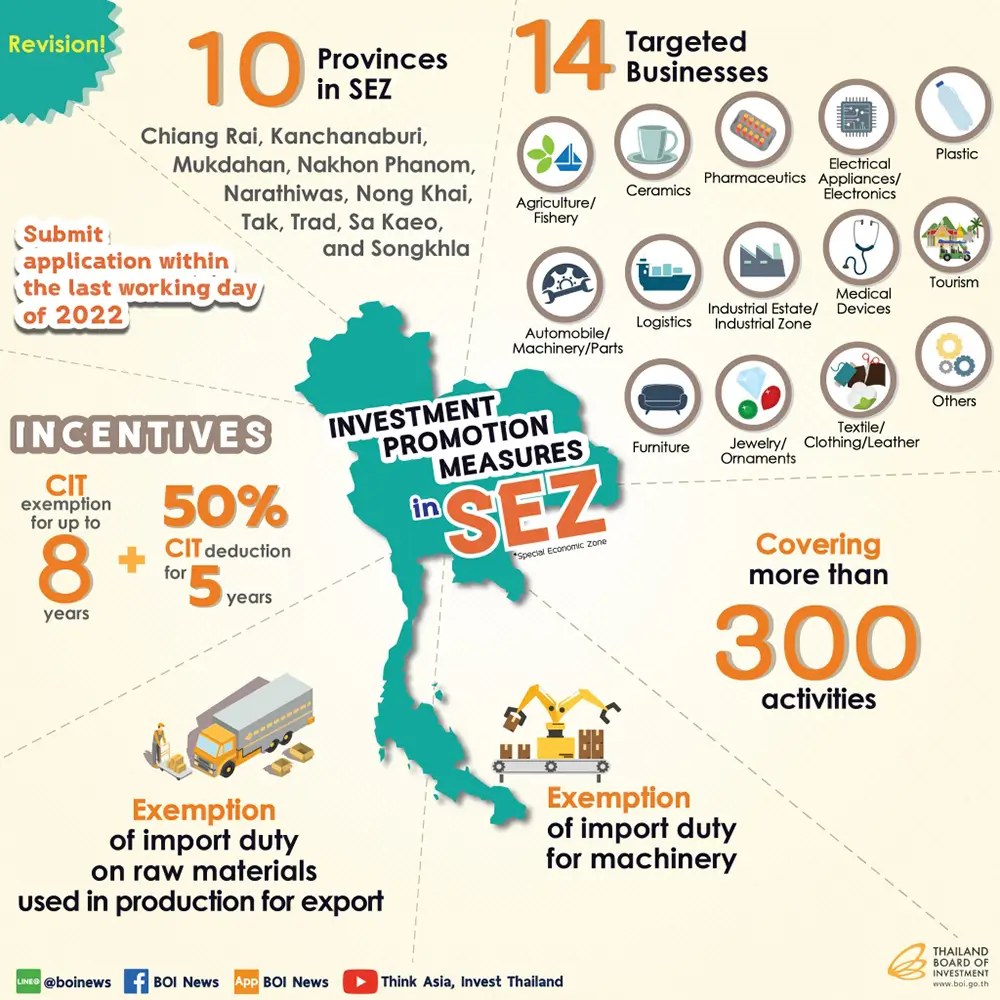

The establishment of SEZs is part of Thailand’s forward-thinking strategy to drive sustainable economic growth. Initiated in 2015, SEZs are strategically located in 10 border provinces: Tak, Sa Kaeo, Mukdahan, Trat, Songkhla, Nong Khai, Nakhon Phanom, Kanchanaburi, Narathiwat, and Chiang Rai. These zones aim to create thriving trade and investment opportunities while reducing economic disparities and promoting local development.

The Thai government has gone to great lengths to support these zones through a range of measures. These include:

- Investment incentives** tailored to the unique potential of each SEZ.

- One-stop service centers** for labor and investment management, simplifying processes for investors.

- Infrastructure development** to improve connectivity and logistics.

- Customs facilitation** to streamline cross-border trade.

- Allocation of land** for investment purposes, ensuring businesses have the resources they need to thrive.

Initially overseen by the National Policy Committee on Special Economic Zones, the development of SEZs is now managed by the Policy Committee on Special Economic Development Zones, established under 2021 Prime Minister’s Office regulations. This ensures continuity in driving SEZ development forward.

Expanded Investment Incentives: A Broader Horizon for Businesses

In January 2023, the Thai government expanded investment incentives for SEZs to align with evolving economic trends and local potential. The Board of Investment (BOI) increased the number of targeted business categories from 72 to 89 across 13 groups. These include high-potential sectors such a

· Renewable energy production.

- Waste-to-energy fuel production.

- Medical centres and the manufacturing of medical foods.

- Traditional medicine services.

- Human resource development initiatives.

These incentives reflect Thailand’s adaptability to emerging industries and aim to attract consistent investment that drives economic activity within SEZs.

Why Invest in Thailand’s SEZs?

Thailand’s SEZs are strategically positioned along key border areas to serve as gateways to regional markets, including the ASEAN Economic Community (AEC). With their proximity to neighbouring countries, these zones are ideal for businesses looking to tap into cross-border trade opportunities and benefit from a robust supply chain network.

Investing in SEZs not only provides financial advantages, such as tax reductions, but also grants access to a growing, dynamic market and a government eager to support sustainable development. With infrastructure upgrades, streamlined processes, and a wealth of incentives, Thailand’s SEZs represent an unparalleled opportunity for investors seeking long-term growth and regional expansion.

Seize the opportunity to be part of Thailand’s economic future—invest in SEZs and unlock the potential of Southeast Asia’s booming markets.

Ready to take advantage of these opportunities?

AO’s legal team, together with Business advisory teams, are here to help you establish your business from start to finish. From legal compliance to strategic advisory, we ensure a seamless journey for your investment in Thailand’s SEZs.

About AO-Group

AO, based in Bangkok specializes in providing expert tax and accounting solutions tailored to businesses and individuals in Thailand. With over 20 years of experience, we simplify complex processes like Withholding Tax (WHT) compliance and refunds, helping our clients maximize financial efficiency while adhering to Thai regulations.

At AO, we are committed to delivering personalized, results-driven support for all your tax needs.

FAQs about for Businesses in Thailand’s Special Economic Zones (SEZs)

Q: What are the main tax incentives available for businesses in Thailand’s Special Economic Zones (SEZs)?

A: The main tax incentives available for businesses in Thailand’s SEZs include corporate tax exemptions, tax holidays, import duty exemptions on machinery and raw materials, and various tax credits for R&D activities. These incentives are designed to attract investors and promote development in specific sectors.

Q: How does the Board of Investment (BOI) facilitate tax incentives for investors in Thailand?

A: The Board of Investment (BOI) plays a crucial role in facilitating tax incentives for investors by providing a range of financial incentives, including tax holidays, reduced corporate tax rates, and import duty exemptions. The BOI also assists with the application process and ensures that eligible firms understand the available benefits.

Q: What is a tax holiday, and how does it apply to businesses in SEZs?

A: A tax holiday is a temporary period during which a business is exempt from paying certain taxes, such as corporate tax. In Thailand’s SEZs, firms may qualify for a tax holiday for a specified period, allowing them to reinvest profits and enhance their operations without the burden of tax liability.

Q: Can businesses in Thailand’s SEZs benefit from non-tax incentives?

A: Yes, businesses in Thailand’s SEZs can benefit from non-tax incentives, which may include subsidies for innovation, assistance in obtaining permits, and support for R&D services. These incentives are designed to enhance the overall business environment and encourage investment in targeted sectors.

Q: What requirements must a firm meet to be eligible for tax credits and incentives in Thailand?

A: To be eligible for tax credits and incentives in Thailand, a firm must typically be registered with the BOI, operate within designated SEZs, and engage in approved activities that align with the government’s development goals. Specific criteria may vary depending on the type of incentive sought.

Q: How does the tax system in Thailand affect foreign investors in SEZs?

A: The tax system in Thailand offers favorable conditions for foreign investors in SEZs, including lower corporate tax rates, tax exemptions, and various tax credits. This system is designed to create an attractive investment climate and stimulate economic development.

Q: Is there a limit on the period of corporate income tax (CIT) exemption for businesses in SEZs?

A: Yes, there is typically a limit on the period of corporate income tax (CIT) exemption that businesses can enjoy in SEZs. This period can vary based on the type of activity and the specific incentives available, but it often ranges from three to eight years.

Q: What types of expenditures can qualify for tax deductions in Thailand’s SEZs?

A: Expenditures that may qualify for tax deductions in Thailand’s SEZs include costs related to innovation, R&D services, machinery purchases, and essential materials for production. These deductions can help reduce taxable income and enhance cash flow for businesses.

Q: How can a company apply for tax credits or exemptions in Thailand’s SEZs?

A: A company can apply for tax credits or exemptions in Thailand’s SEZs by submitting an application to the Board of Investment (BOI) along with the required documentation that demonstrates eligibility. The BOI will review the application and, if approved, will issue a certificate detailing the eligible incentives.