Corporate tax filing in Thailand can be daunting—especially for new businesses or foreign companies navigating local regulations for the first time. Among the many requirements, two key documents every company must understand and file are PND.50 and SBC.3.

In this article, we break down what these forms are, why they matter, and how to stay compliant with Thai Revenue Department rules. Plus, we explain how AO Accounting & Advisory is here to help you stay on track and avoid penalties.

What Is PND.50?

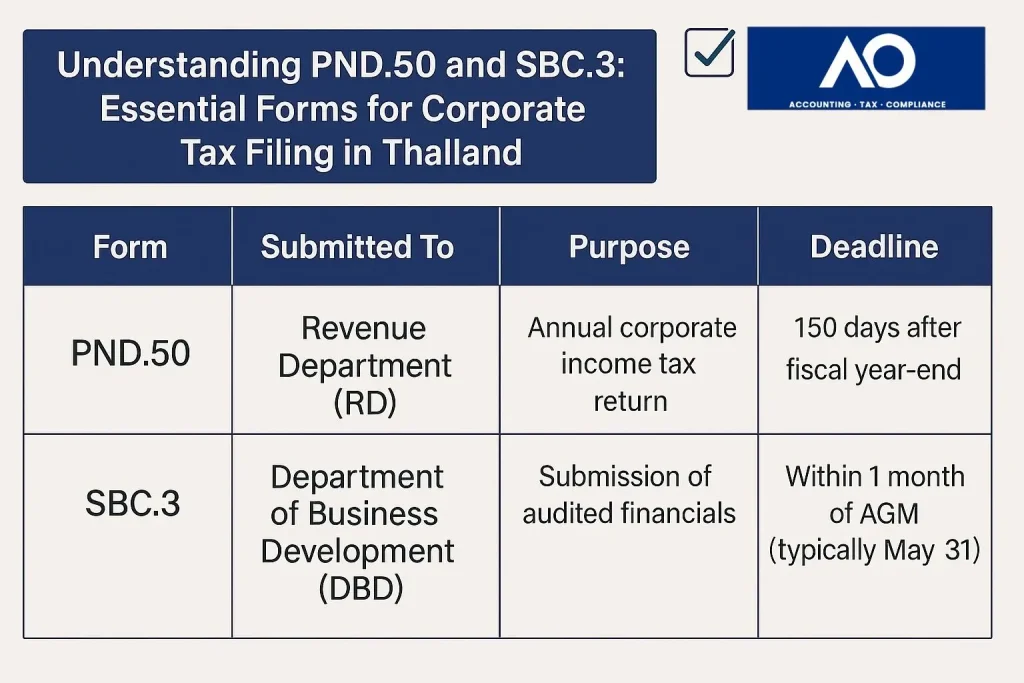

PND.50 is the official Annual Corporate Income Tax Return form in Thailand. Every juristic company or partnership—regardless of size, profit, or level of activity—must file this form once a year.

Key Details:

- Name: PND.50 (แบบแสดงรายการภาษีเงินได้นิติบุคคลประจำปี)

- Filing Deadline: Within 150 days after the company’s accounting year-end

- For most companies with a fiscal year ending December 31, the deadline is May 30 of the following year.

- Submitted To: The Revenue Department of Thailand

- Filing Method: Can be submitted electronically (e-filing) or in paper form

What Information Does PND.50 Contain?

This form summarizes your company’s entire year of financial activity, including:

- Gross revenue and total expenses

- Net profit or loss

- Deductions and exemptions under Thai tax law

- Details of any prepaid corporate income tax (e.g., from PND.51)

- Final calculation of Corporate Income Tax payable or refundable

This is the government’s official record of your business’s annual performance and tax obligations. Filing this form is non-negotiable—even if your business had no income or activity during the year.

Why Is PND.50 Important?

Failing to file PND.50 on time, or filing it incorrectly, can result in serious legal and financial consequences:

- Late filing penalties

- Surcharges on unpaid tax (1.5% per month)

- Audits or investigations from the Revenue Department

- Problems when applying for work permits, business visas, or BOI incentives

That’s why accurate financial records, timely audit reports, and correct tax calculations are essential before you submit PND.50.

What Is SBC.3?

SBC.3 (Thai: แบบ ส.บช.3) is the official form used to submit your audited financial statements to the Department of Business Development (DBD) under the Ministry of Commerce.

While PND.50 is submitted to the Revenue Department, SBC.3 goes to the DBD—but both are mandatory and interlinked.

SBC.3 Filing Deadline:

- Must be filed within 1 month after the company’s Annual General Meeting (AGM)

- AGM must be held within 4 months after the fiscal year-end

- In total: SBC.3 is generally due within 5 months after your year-end

- For most companies: Deadline is May 31

What Does SBC.3 Include?

The SBC.3 form must include:

- Full set of audited financial statements

- Company’s shareholder list

- Minutes of the AGM where the financials were approved

- Certification from licensed Thai auditors

This document is critical because it publicly discloses your company’s financial performance and fulfills your compliance obligations with the Ministry of Commerce.

Why Is SBC.3 Important?

Filing SBC.3 ensures transparency and legal compliance under Thai corporate law.

Missing the deadline or filing inaccurate financials can result in:

- Fines of up to THB 50,000

- Suspension or revocation of your company registration

- Reputation damage (especially for BOI or publicly visible companies)

SBC.3 also plays a crucial role when:

- Renewing business licenses

- Applying for loans or investment

- Seeking BOI promotion or incentives

- Proving compliance during due diligence (e.g., M&A or investment deals)

Summary: PND.50 vs SBC.3

Both forms are compulsory and must be filed annually. Together, they ensure that your company is tax-compliant and legally operational under Thai law.

How AO Accounting & Advisory Can Help

At AO Accounting & Advisory (AO), we’ve helped local and international businesses file PND.50 and SBC.3 accurately, efficiently, and on time for over 15 years.

We provide:

- Preparation of audited financial statements

- Coordination with licensed auditors

- Timely filing of PND.50 and SBC.3

- Tax planning to legally reduce liability

- Ongoing compliance support and guidance

Whether you’re a startup, SME, or multinational in Thailand, we handle the accounting so you can focus on your business.

Final Thoughts

Corporate tax filing isn’t just about ticking boxes—it’s about demonstrating that your business is legitimate, organized, and ready for growth.

By understanding and filing PND.50 and SBC.3 on time, you avoid legal issues, protect your business reputation, and build trust with regulators and partners.

Don’t wait until the last minute. Let AO Accounting & Advisory be your trusted partner in compliance!

FAQs on PND.50 and SBC.3

Q: What is PND 50 in the context of Thailand corporate tax filing?

A: PND 50 is a withholding tax return that companies in Thailand must file for their employees’ income tax contributions. This form is used to report monthly withholding tax and is crucial for compliance with personal income tax regulations.

Q: How does SBC 3 relate to corporate tax filing in Thailand?

A: SBC 3 is a specific form related to the annual corporate income tax return in Thailand. It is used to report the company’s financial statements, including profit and loss accounts, and must be certified by the revenue department.

Q: What types of visas are relevant for foreign business owners in Thailand?

A: Foreign business owners typically require a non-immigrant B visa to operate a business in Thailand. Additionally, a business visa can be extended for long-term stays, and extensions are processed through the immigration bureau.

Q: What are the requirements for filing VAT in Thailand?

A: To file VAT (Value Added Tax) in Thailand, businesses must register with the revenue department and file monthly VAT returns (PP 30). The financial statements must also reflect the VAT collected and paid during the reporting period.

Q: How does withholding tax impact my company’s financial statements?

A: Withholding tax affects a company’s financial statements as it is deducted from employee salaries and must be reported on the PND 50 form. It also impacts cash flow and needs to be accurately reflected in the profit and loss account.

Q: What documents are needed for a visa extension in Thailand?

A: For a visa extension, you typically need a valid passport, a certificate of incorporation of the company, proof of business operations, and any documents required by the immigration office. The visa and immigration team can assist with this process.

Q: Are there specific tax obligations for foreign employees working in Thailand?

A: Yes, foreign employees are subject to personal income tax in Thailand. Employers must withhold the appropriate monthly withholding tax (PND 50) from their salaries and ensure compliance with local tax regulations.

Q: What is the role of a certified public accountant in corporate tax filing?

A: A certified public accountant (CPA) in Thailand helps businesses prepare and file their tax returns, including PND 50 and SBC 3 forms. They ensure that all financial statements are accurate and comply with the regulations set by the revenue department.

Q: How can businesses ensure compliance with social security contributions in Thailand?

A: Businesses must register their employees with the social security office and file social security contributions on time. This includes submitting the necessary forms, such as PP 36, to ensure compliance with Thai labor laws.

Q: What should I do if I need to hire foreign employees for my Thai business?

A: If you plan to hire foreign employees, you need to secure a non-immigrant B visa for them and ensure that you comply with all regulations regarding work permits and tax obligations, including withholding tax returns like PND 50.